Written by David Rosbotham DipPFS | Financial Planner

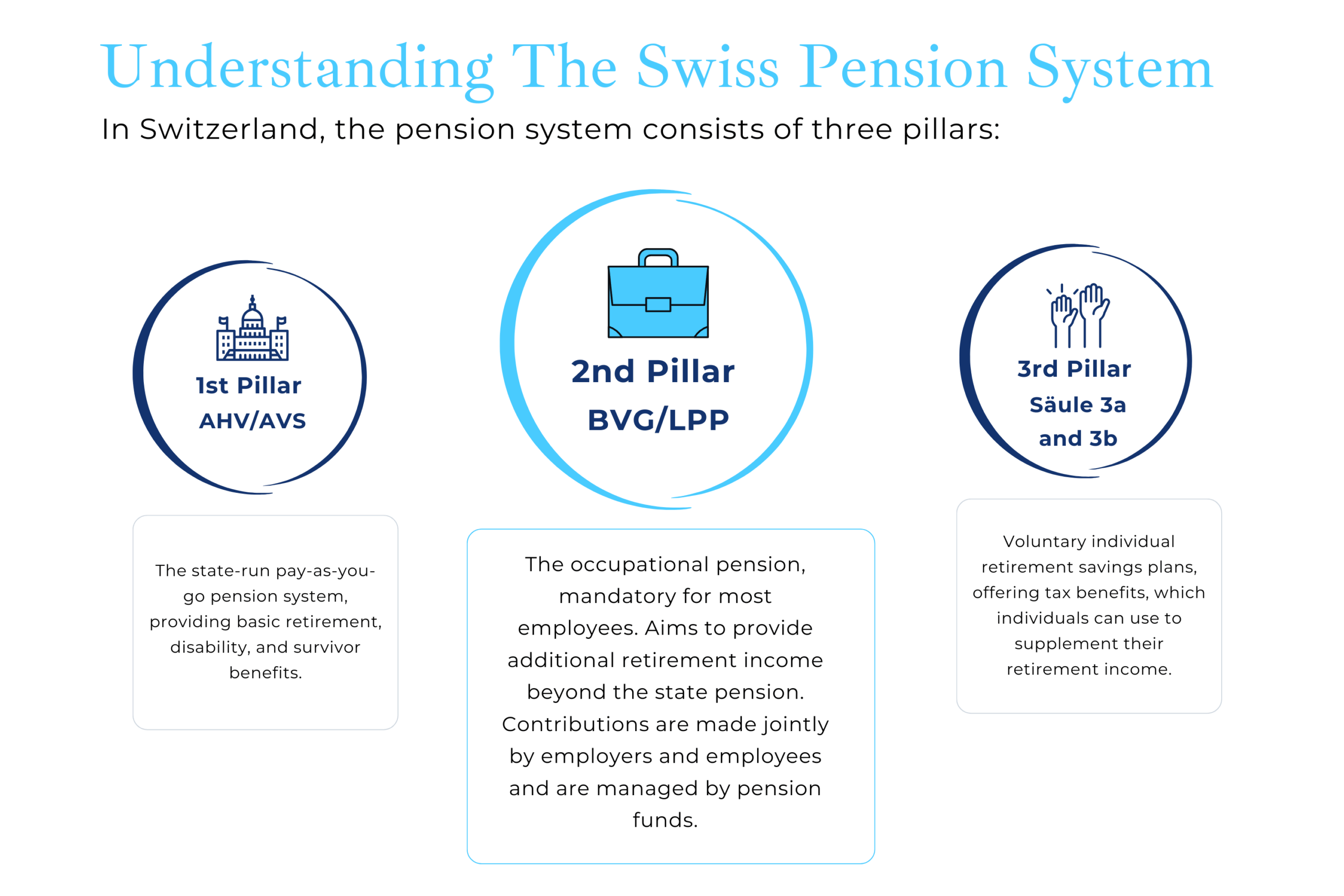

When it comes to retirement planning in Switzerland, one of the cornerstones of financial security is the Swiss 2nd Pillar Pension, also known as the 2nd pillar. As an expat, understanding and optimising your contributions to this pillar is essential for securing a comfortable retirement.

What is the Swiss 2nd Pillar Pension?

The 2nd pillar is an occupational pension scheme that is designed to benefit every individual who has been employed in Switzerland and has made contributions to the LPP (Loi fédérale sur la prévoyance professionnelle vieillesse, survivants et invalidité). It is a mandatory pension fund designed to ensure financial security during retirement.

Who is eligible for the 2nd pillar?

Eligibility for the second pillar is straightforward.You’ll be enrolled automatically if the following conditions apply:

-

You’re already contributing to the AHV/AVS (first pillar) system.

-

You’re at least 17 years old and have not yet reached retirement age. From the 1 January after your 17th birthday, you’re insured for disability and death benefits. From the 1 January after your 24th birthday, you also begin contributing toward retirement benefits.

-

You earn an annual salary over CHF 22,680 from a single employer.

Contributions to the second pillar are deducted directly from your salary and channeled into your designated pension fund. The contribution amount is calculated as a percentage of your salary, ensuring that you are building a financial safety net for your retirement years.

How Contributions Work

Expats should strive to maximise their contributions to the 2nd pillar. This is a joint effort between employees and employers and plays a significant role in determining your retirement income. By contributing as much as possible to this pillar, you’re setting the stage for a financially secure future.

Using Voluntary Contributions for Added Security

While mandatory contributions are a part of the 2nd pillar, there are opportunities for voluntary contributions. Making voluntary payments can help to boost your pension savings even further, ultimately providing you with a more substantial financial cushion in retirement. These voluntary contributions can be a strategic move to enhance your retirement security.

What is the 2nd Pillar Conversion Rate used for?

Understanding the conversion rate is crucial. This rate determines how pension assets are converted into an annuity, which is a regular payment made to you during retirement. However, it’s important to consider whether the lump sum option might be more advantageous for you personally.

Remember, there is no one-size-fits-all solution in financial advice. Your decision should be tailored to your specific financial goals and circumstances.

Is an annuity right for you?

It’s important to note that annuities are only available for clients who reach a certain age. The eligibility criteria for annuities are specific and can impact your retirement planning strategy.

Is Financial Advice necessary to navigate the Swiss pension system?

Navigating the Swiss Pension System can be challenging. The terminology and intricacies can often feel like a minefield. That’s why it’s highly advisable to seek professional guidance. A financial adviser with expertise in Swiss pensions can help clarify unfamiliar terms, assist in understanding your annual Pension Statement, and most importantly, provide insight into how your decision to take a lump sum or annuity option from your Swiss Pension will impact your overall retirement plans from a tax perspective.

Pro Tip: Every individual’s retirement plans are unique. Don’t solely rely on advice from friends or colleagues. While their circumstances may appear similar, personal objectives and long-term plans can be vastly different. Tailored advice and strategies are the key to a successful retirement plan.

To learn more about optimising your Swiss 2nd Pillar Pension and explore personalised pension planning services, visit our Pension Planning Page. Our team of experts is here to guide you towards a secure and prosperous retirement.