Written by David Rosbotham DipPFS | Financial Planner

When most people think about retirement, the first thing that comes to mind is money: pension balances, investment portfolios, and spreadsheets full of projections. And while money is vital, the meaning of life after retirement often comes from other areas: identity, relationships, daily routines, and purpose. Many people discover that the toughest challenges of retirement aren’t financial at all, but personal.

Retirement isn’t just a math problem. It’s a life transition, one that reshapes your identity, your relationships, your daily routine, and even the way you think about the future.

Who Are You Without the Job Title?

For decades, work gives us more than a pay-check. It provides structure, purpose, recognition, and a sense of belonging. When that disappears, it can feel disorienting. Many new retirees find themselves asking: Who am I now that I’m not a manager, a lawyer, a consultant, or an executive?

This identity shift is one of the most underestimated challenges of retirement. Psychologists often describe it as a “loss of role,” where the professional identity you carried for years suddenly vanishes. Without the anchor of a job title, it’s easy to feel uncertain about your place in the world.

The retirees who navigate this transition best are those who proactively create new roles for themselves. Some volunteer, others mentor younger professionals, some dive into hobbies or creative pursuits they never had time for. A few even start passion businesses or take on part-time consulting. The key is to build an identity that excites you, not just to fill the hours, but to feel useful and fulfilled.

A useful exercise is to think about your retirement identity not as a single title but as a portfolio of roles. Instead of ‘retired banker,’ you might now be a mentor, gardener, traveller, and community volunteer. By embracing this more flexible self-image, you replace the loss of one title with a richer, more fulfilling sense of purpose.

The Emotional Side of Retirement

Leaving behind a career isn’t just freeing, it can also feel like a loss. A loss of daily structure. A loss of colleagues and office camaraderie. A loss of being needed. It’s normal to go through a period of grief after you retire.

As an adviser, I often remind clients that retirement is not a one-time event, but a transition process. Many people experience what’s called a “honeymoon phase”, the early months filled with holidays, hobbies, and freedom. But once that excitement settles, there can be a dip in mood or motivation as the reality of long, unstructured days sets in.

Planning for this emotional shift is just as important as planning your finances. Journaling, therapy, or simply talking openly with family can help retirees process the change. Creating new routines before you stop working, perhaps trying a reduced schedule, volunteering, or taking up a hobby, can make the transition smoother. The clients who thrive emotionally are usually the ones who treat retirement not as an ending, but as the beginning of a new chapter they can design deliberately.

Retirement and Relationships: Why Connection Matters

Retirement often changes the dynamics at home. Couples suddenly spend much more time together than they’re used to, which can be both rewarding and challenging. At the same time, the network of colleagues you’ve relied on for years may gradually fade.

Strong social connections are one of the most important factors for happiness and longevity in retirement. I encourage clients to think about relationships as part of their retirement plan, just like pensions and investments. That could mean joining clubs, volunteering, picking up group hobbies, or simply scheduling regular time with friends and family.

For couples, honest conversations about expectations can prevent stress. It’s worth asking: How much time will we spend together? What activities will we share, and which ones will we enjoy separately? By planning intentionally, you can avoid the ‘retirement shock’ that some couples face when daily life suddenly looks very different.

Facing the “What Ifs” in Retirement Planning

Financial planners often talk about market risk or longevity risk, but retirees wrestle with another set of questions:

- What if my health changes suddenly?

- What if my spouse passes away before me?

- What if I can’t do the things I’ve dreamed of?

These aren’t easy questions, but ignoring them only creates anxiety. Proactive planning, both financial and non-financial, can make a real difference. For example, ensuring you have a healthcare directive, reviewing insurance, and keeping your estate planning documents up to date all help reduce uncertainty. On the non-financial side, thinking ahead about your home, lifestyle, and support network gives you a stronger sense of security.

This isn’t about pessimism, it’s about resilience. The retirees who feel most confident are the ones who have asked these questions, explored different scenarios, and taken sensible steps to prepare.

The Real Retirement Dividend: Meaning

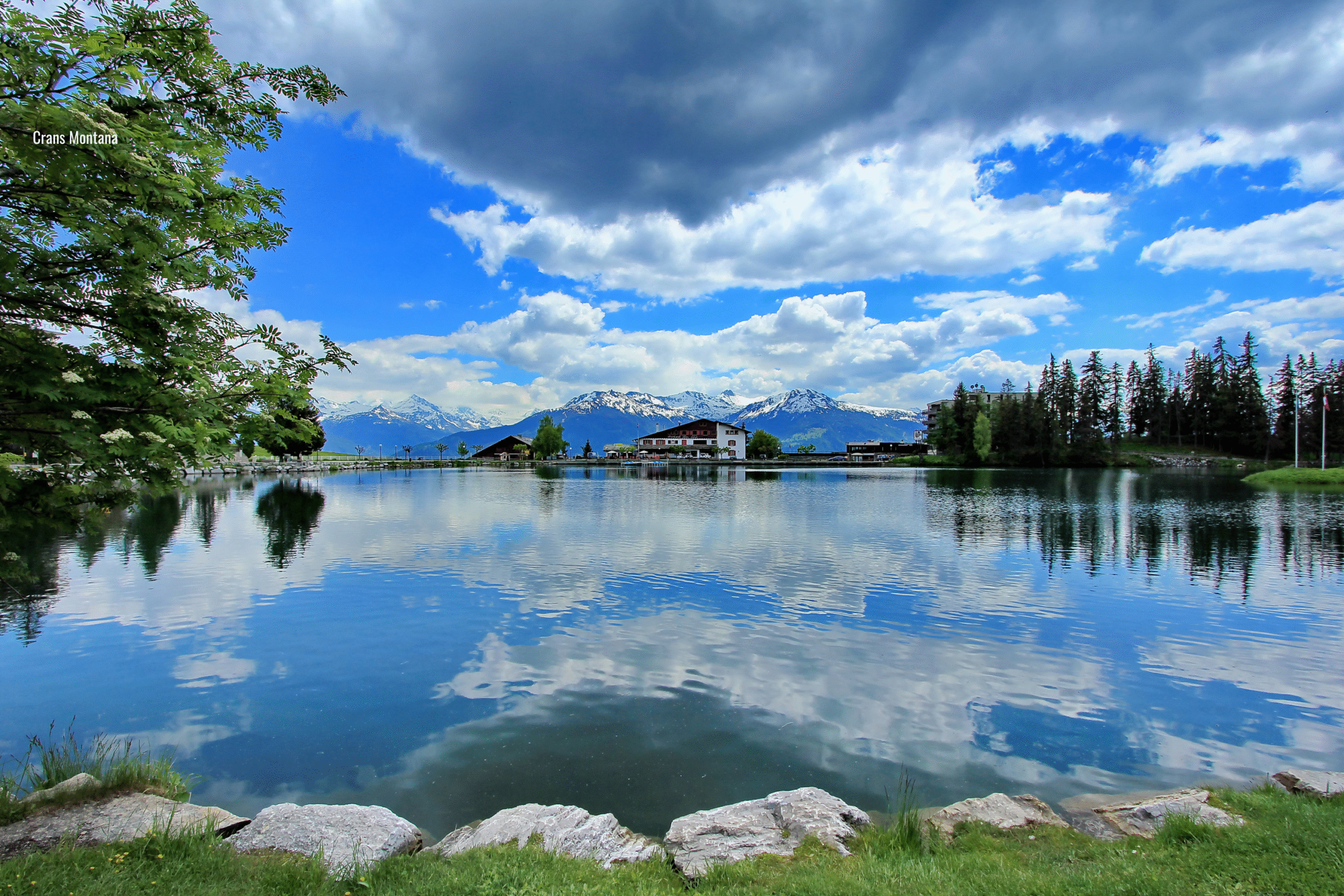

At its core, retirement isn’t just about leaving work. It’s about moving toward something new. The happiest retirees are the ones who create meaning in their daily lives. That might mean travel, family time, learning, creativity, volunteering, or giving back. Purpose is what makes the years after work rich and satisfying.

Purpose doesn’t have to be grand. It might be mentoring, spending more time with family, or mastering a new skill. What matters is that it feels meaningful to you. As an adviser, I encourage clients to think about purpose alongside pensions and investments, because meaning is what makes the financial plan worth it.

Retirement Beyond Money for Expats

For expatriates, retirement brings an extra layer of complexity. It isn’t just about leaving work behind, it often involves questions about where to retire, which country’s pension systems apply, and how lifestyle expectations may shift abroad. Beyond finances, expats may also face cultural adjustments, distance from family, and the challenge of building new social networks in retirement.

One of the most overlooked aspects for expats is identity. After years of being defined as ‘the foreign professional,’ retirement can feel like losing two identities at once, the work role and the expat role. Planning ahead for how to stay connected, whether through community groups, volunteering, or maintaining strong ties back home, can ease this transition.

Another key consideration is relationships and support systems. For expats who have lived away from their extended families, retirement is an opportunity to think carefully about where you want to live to balance lifestyle, healthcare, and social connection.

Final Thoughts: Planning for a Life You Want to Live

Yes, money matters. Without financial security, retirement becomes stressful. But money alone won’t create happiness or fulfilment. The retirees who thrive are those who plan for more than the balance sheet. They plan for identity, for relationships, for health, and most importantly, for meaning.

So as you think about your own retirement (or support others through theirs), remember this: the spreadsheets are only half the story. The rest is about building a life you actually want to live.